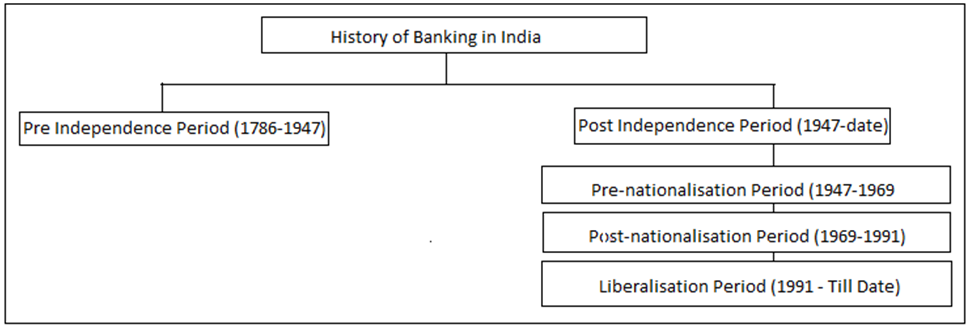

HISTORY OF BANKING SYSTEM IN INDIA

Banking in India dates back to the days before India got Independence that is before 1947.

Over the years banking in India have seen many changes in Technology. Major changes in the banking system and management have been seen over the years with the advancement in technology, considering the needs of people.

The banking sector development can be divided into three phases:

Phase I: The Early Phase which lasted from 1770 to 1969

Phase II: The Nationalization Phase which lasted from 1969 to 1991

Phase III: The Liberalization or the Banking Sector Reforms Phase which began in 1991 and continues to flourish till date

Pr-Independence Period (1786-1947)

“Bank of Hindustan” was the first Indian bank established in 1770 in culcutta capital of India back then.

However it failed to work and its operations was ceased in 1832.

Around 600 banks like “Bank of Hindustan” was established during pr-Independence Period but only few managed to survive. Britisher’s introduced Bank of Bengal, Bank of Bombay and Bank of Madras and called them the Presidential Banks which later got merged in 1921 and known by the “Imperial Bank of India” and then nationalized in 1955 named as “State Bank of India”.

Given below is a list of other banks which were established during the Pr-Independence period:

| Bank Name | Year of Establishment |

| Allahabad Bank | 1865 |

| Punjab National Bank | 1894 |

| Bank of India | 1906 |

| Central Bank of India | 1911 |

| Canara Bank | 1906 |

| Bank of Baroda | 1908 |

Post Independence Period (1947-1991)

Post Independence Period then government decided to nationalize banks to help rural people to lend money directly from bank instead of money lenders. These banks were nationalized under Banking Regulation Act, 1949. 14 banks were nationalised between the time duration of 1969 to 1991.These were the banks whose national deposits were more than 50 crores.

Given below is the list of these 14 Banks nationalised in 1969:

- Allahabad Bank

- Bank of India

- Bank of Baroda

- Bank of Maharashtra

- Central Bank of India

- Canara Bank

- Dena Bank

- Indian Overseas Bank

- Indian Bank

- Punjab National Bank

- Syndicate Bank

- Union Bank of India

- United Bank

- UCO Bank

In the year 1980, another 6 banks were nationalised, taking the number to 20 banks. These banks included:

- Andhra Bank

- Corporation Bank

- New Bank of India

- Oriental Bank of Comm.

- Punjab & Sind Bank

- Vijaya Bank

Apart from the above mentioned 20 banks, there were seven subsidiaries of SBI which were nationalised in 1959:

- State Bank of Patiala

- State Bank of Hyderabad

- State Bank of Bikaner & Jaipur

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Saurashtra

- State Bank of Indore

Liberalization Period (1991-till date)

From 1991 onwards, there was a sea change in the Indian economy. The government invited private investors to invest in India. Ten private banks were approved by the RBI. A few prominent names which exist even today from this liberalization are HDFC, Axis Bank, ICICI, DCB and Indus Ind Bank.

In the early to mid-2000s, two other banks, Kotak Mahindra Bank (2001) and Yes Bank (2004), received their licenses. IDFC and Bandhan banks were also given licenses in 2013-14.

Various Types of Banking Services

The flow chart given below shows the following types of banking services.

1. Central Banking Services

2. Commercial Banking Services

3. Specialized Banking Services

4. Non-banking financial services;

1. Central Banking Services:

- issues currency & bank notes;

- discharges the treasury functions of the Government,

- manages the money affairs of the nation & regulates the internal and external value of money

- Acts as the bank of the Government and also acts as the bankers’ bank.

2. Commercial banking services:

- receiving different types of deposits

- providing different types of loans

- Extending some non-banking customer services like facilities of locker, rendering services in paying directly house rent, electricity bill, share-calls. Money or insurance premium.

- Commercial bank also advises on investment, re-investment, allotment or transfer of funds.

3. Specialized banking services:

Special banking institutions are established for definite specialized banking services.

- Industrial banks to supply industrial long term credit and working capital

- Land mortgage bank for granting loans on equitable mortgage

- Rural Credit Banks for generating funds for extending rural credit

- Developmental banks to support any developmental activities. These types of banks accept all types of deposits but mobilises the amount in its specially focused area.

4. Non-Banking Financial Services:

Mutual funds are institutions accepting finances from its members and investing in long term capital of companies both directly in the primary market and indirectly in the capital market. Financial institutions acting as portfolio managers receive fund for the public and managing the funds for or on behalf of its depositors. This port- folio manager undertakes the responsibility of managing the funds of the principal so as to generate maximum return.

How Banks Worked Before Computers

The banks use to maintain ledgers and folio numbers for each account where all the transactions were recorded. Customer information were stored in individual post card like data sheet where the customer’s name, photo, specimen signatures were kept in record. These cards were placed in several box type files. When one needs withdrawal of money, you write a cheque or withdrawal slip in some banks and give it along with your passbook to the clerk. There may be several clerks in a larger branch that will process a range of specific account numbers. The clerk will issue a token for receipt of the same. The clerk then, checks the ledger to see if you have balance in your account to process withdrawal request. If balance is available then he posts the entry in the ledger and the pass book and passes the passbook plus withdrawal slip or cheque to the officer. The officer search through the box files to check if your signature as per data card tallies with that in the cheque. If signature tallies then he will sign the cheque to be processed by the cashier to disburse cash.

The movement of cheque from clerk to officer to cashier would take anywhere between 15 minutes to an hour and one has to follow up. The movement of paper is done at the mercy of office peon who was the busiest person as his name will be called out by every staff of the bank.

After the cheque reaches cashier, he will call the token number and disburse cash .when the cashier did not have enough cash to disburse then u have to wait till another customer comes and deposit cash into the bank. The banks also calculate quarterly interest on savings account manually and post it on the ledger.

Impact of Digitalization on the Indian banking sector

Digitalization is the latest expression in all the sectors. It refers to the use of digital technologies to change a business model and further provide new revenue and value-producing opportunities. The world is growing rapidly in the terms of advancement in technology over the past decades. Technology has left an inevitable mark on everything and anything that human beings can understand. There has been various technological outburst in all sectors and banking has been one of the them to adopt technological advancement. All over the world, banks are making a tremendous steps towards digitalization to overcome with the competition and provide their clients best services.

“Digital Banking” refers to digitalizing the traditional methods of banking to conduct banking transaction more smoothly. Contrary to traditional banking, digitalized banking aims to make versatile computerized products and services to fulfill the requirements of their digitalized clients. The introduction of digital banking has revolutionized the banking sector and modified the entire procedure bank transfers, it has facilitated the purchasers assisting them to see their account details,pay online bills and transfer money from one account to the opposite during a faster way.

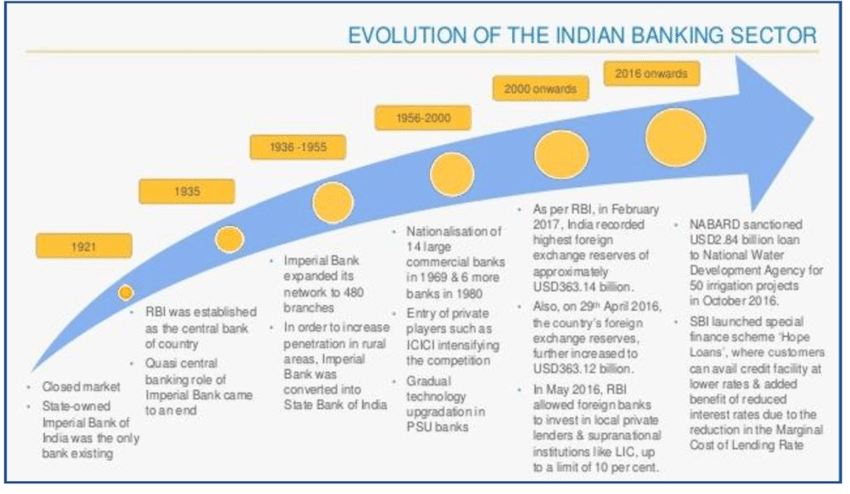

DIGITALIZATION IN THE BANKING SECTOR AND ITS EVOLUTION

The need for computerization was felt within the Indian banking sector within the late 1980s, where there was a need to enhance the customer service, book-keeping and MIS reporting.

In the late 1980s, India was marred by various financial reforms and therefore the banking sector felt a requirement to enhance customer services and computerization of recording and accounting of knowledge. A committee was found out in 1988 by the Federal Reserve Bank of India which was headed by Dr C. Rangarajan to review Computerization within the Banking Sector. After the introduction of the Liberalization, Privatization, and Globalization (LPG) policy, the method of digitalization picked up the pace alongside the change within the Indian Economy.

The digitalization within the banking sector is often seen in India since the establishment of ATMs. Further developments like Tele-banking, Electronic Compensation Service, Electronic Funds Transfer system, MICR, RTGS (Real-Time Gross Settlement), Point of sale terminal, etc. are often seen within the banking sector. E-banking has resulted in reducing costs drastically and has helped generate revenue through various channels. Various steps and initiatives had been adopted by the RBI and National Payment Corporation of India in strengthening the Payment and Settlement Systems in banks just like the launch of United Payments Interface (UPI) and Bharat Interface for Money. It is due to such initiatives and platforms, customers now don’t have to store or carry cash alongside them anymore, they will now make transactions anywhere at any time.

Digital Banking Challenges and Advantages For the Banking Industry

Digital banking challenges

1. Security

Hackers are still giving financial institutions a run for their money. Therefore, some customers are not willing to take any chances.

2. Fully digitized bank, brick, and mortar or both

some people are not convinced about digital banking unless they have proof that a bank exists in brick and mortar form. This makes it hard for digital banking to become completely digitized.

3. An evolution from ancient banking systems

Most banking systems use COBOL programming language which is not meant to technologies which we have today.

4. The non-financial institution already filling the space

Several non banking institutions are giving sevices like digital banking for example whatapp allows user to send money directly to bank accounts. They have less rules and regulations as compare to financial institutions which making difficult for financial institutions to cope up.

5. Internal barriers

Digitalizing means whole banking system and employees have to go through changes. Digitalization may need employee training and it can also make banks to layoff some employee.

6. To buy or build the banking system

With the demand for digital banking on the high, some banks are desperate to take the leap and adopt digital banking. However, most banks are not quickly adopting digital banking because they don’t know which kind of system will work correctly. Some prefer purchasing such systems because they want to work with a system that has been tested. Others prefer having a system built specifically for them.

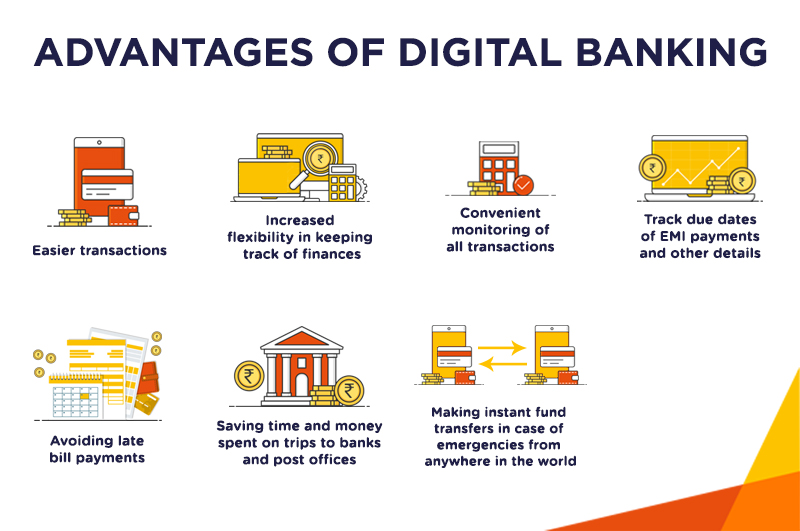

Advantage of Digital Banking

Advantages are the benefits which can make your work better :-

- Mobility Operations

- Additional Free Services

- More Efficient Rates

- Customer Convenience

- Unlimited Transfer at No Cost

- Ease of Use

- Environmental Friendly

IF YOU LIKE THE POST THEN FOLLOW US :

Email us on:

Contact us on:

Landline no:+911353558143

Mobile no:

+919808724448

Facebook id:

Linkedin id:

Website:

For these type knowledge contact us :

Digi Hub Solution

Digital Service Provider