This article is about the Government Sites for people &This article is for sites made by the goverment .The sites form which people take advantage of the facilities provided by the government .

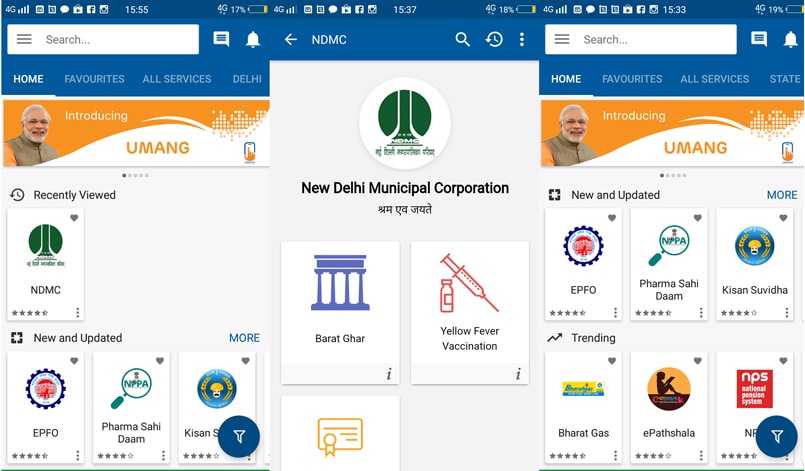

UMANG WEBSITE/APP:

UMANG Full Form – What Does UMANG Stands For? UMANG UPSC – UMANG stands for Unified Mobile Application for New-age Governance. It is a mobile application launched by PM Narendra Modi to provide secured access to the citizens to multiple government services at one platform.

UMANG is a key component of the Digital India initiative of the government that intends to make all traditional offline government services available 24 * 7 online through a single unified app.

Like UMANG, there are various other schemes or services launched by the Government of Indian in order to address the social and economic welfare of the citizens of the nation. The links of a few related schemes launched by the government are given below.With a thought to add convenience to the lifestyle of the Indian citizens, UMANG has been created. The services of the app are made available on multiple channels like web and mobile application, IVR and SMS that can be easily accessed through feature phones, smartphones, desktops, laptops and tablets. It provides seamless integration with popular customer-centric services like Digilocker, Aadhaar, and more.

PAN CARD PORTALS LINK:

https://incometaxindia.gov.in/

Application for fresh allotment of PAN can be made through Internet. Further, requests for changes or correction in PAN data or request for reprint of PAN card (for an existing PAN) may also be made through Internet.

Online application can be made either through the portal of Protean (formerly NSDL eGov) ( or portal of UTITSL . The charges for applying for PAN is Rs. 93 (Excluding Goods and Services tax) for Indian communication address and Rs. 864 (Excluding Goods and Services tax) for foreign communication address. Payment of application fee can be made through credit/debit card, demand draft or net-banking. Once the application and payment is accepted, the applicant is required to send the supporting documents through courier/post to Protean (formerly NSDL eGov)/UTITSL. Only after the receipt of the documents, PAN application would be processed by Protean (formerly NSDL eGov)/UTITSL.

For New PAN applications, in case of Individual and HUF applicants if Address for Communication is selected as Office, then Proof of Office Address along with Proof of residential address is to be submitted to Protean (formerly NSDL eGov) w.e.f. applications made on and after 1st November 2009.

As per RBI guidelines, the entities making e-commerce transactions are required to provide PIN (Personal Identification Number) while executing an online transaction. Therefore, before making payment for online PAN/TAN applications using credit card / debit card / net banking, applicant is required to obtain PIN from Banks whose credit card/debt card/net banking is being used.

FOR INSTANT PAN CARD LINK:

https://eportal.incometax.gov.in/

Electronic or e-filing is the process of filing individual or corporate income tax returns with the relevant tax authority using an authorized tax filing software or website 24/7. It reduces processing time, operating costs, transmission errors, and paper use.

FOR ADHAR CARD PORTAL:

The Unique Identification Authority of India (UIDAI) is a statutory authority established under the provisions of the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 (“Aadhaar Act 2016”) on 12 July 2016 by the Government of India, under the Ministry of Electronics and Information Technology (MeitY). The Aadhaar Act 2016 has been amended by the Aadhaar and Other Laws (Amendment) Act, 2019 (14 of 2019) w.e.f. 25.07.2019.

UIDAI was created to issue Unique Identification numbers (UID), named as “Aadhaar”, to all residents of India. The UID had to be (a) robust enough to eliminate duplicate and fake identities, and (b) verifiable and authenticable in an easy, cost-effective way. As on 31st October 2021, the Authority has issued 131.68 crore Aadhaar numbers to the residents of India.

Under the Aadhaar Act 2016, UIDAI is responsible for Aadhaar enrollment and authentication, including operation and management of all stages of Aadhaar life cycle, developing the policy, procedure, and system for issuing Aadhaar numbers to individuals and perform authentication and the security of identity information and authentication records of individuals.

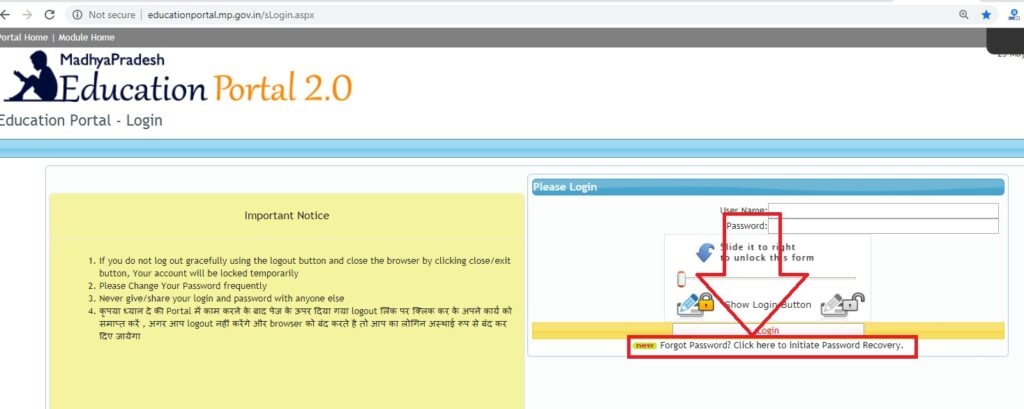

FOR EDUCATION PORTAL:

https://www.education.gov.in View Website Important links Website of Ministry of Education Information on Department of School Education and Literacy Information on Department of Higher Education Website of All India Council of Technical Education

FOR UTTARAKHAND PUBLIC:

Apuni Sarkar Portal is a citizen-centric online services portal.

This portal is developed for the citizens of Uttarakhand to avail their required services online. With this portal, citizens can track their application status in real time. The application status of the respective services will be monitored by all DMs, Departmental Secretaries, Chief Secretary, and honorable Chief Minister.

DIGILOCKER PORTAL:

DigiLocker is a flagship initiative of Ministry of Electronics & IT (MeitY) under Digital India programme. DigiLocker aims at ‘Digital Empowerment’ of citizen by providing access to authentic digital documents to citizen’s digital document wallet. DigiLocker is a secure cloud based platform for storage, sharing and verification of documents & certificates.

E-GREETING-CARDS

The eGreetings portal aims to promote a contemporary and eco-friendly method of sharing greetings by Government officials and agencies as well as citizens to colleagues and friends for National Holidays and other national occasions. The portal allows users to select and send greetings from multiple occasion-specific templates.

ESTAMP PORTAL:

What is E Stamping? E-stamping is referred to as an online method of paying non-judicial stamp duty on the concerned property to the government. This has made the stamp duty and franking process much more convenient than the traditional methods.

E stamp paper is nothing but a stamp paper which is electronic and easily accessible. E stamp paper was introduced in light of the fake stamp papers printed and circulated by telgi. The value of the e stamp paper must be based on the rent amount. For residential purposes 100 rupee stamp paper would suffice.Visit the official website of the SHCIL https://www.stockholding.com/estamp-index.html, .click on e Stamp Services. Select the appropriate state where you want to pay the stamp duty.

Comptroller and Auditor General of India:

Comptroller and Auditor General of India is the apex authority responsible for external and internal audits of the expenses of the National and state governments. It is popularly known as the CAG of India. In this article, we will discuss in brief about the office of the CAG and its functions.

IF YOU LIKE THE POST THEN FOLLOE US :

Email us on:

hubdigisolution@gmail.com

contact us on:

Landline no:+911353558143

Mobile no:

+919808724448

Facebook id:

Linkedin id:

Website:

For these type knowledge contact us :

Digi Hub Solution

Digital Service Provider

Proudly powered by WordPress